Trump Coin Crypto Price Eyes Breakout as Trump Family Expands Crypto Empire

Trump Coin Price Watch

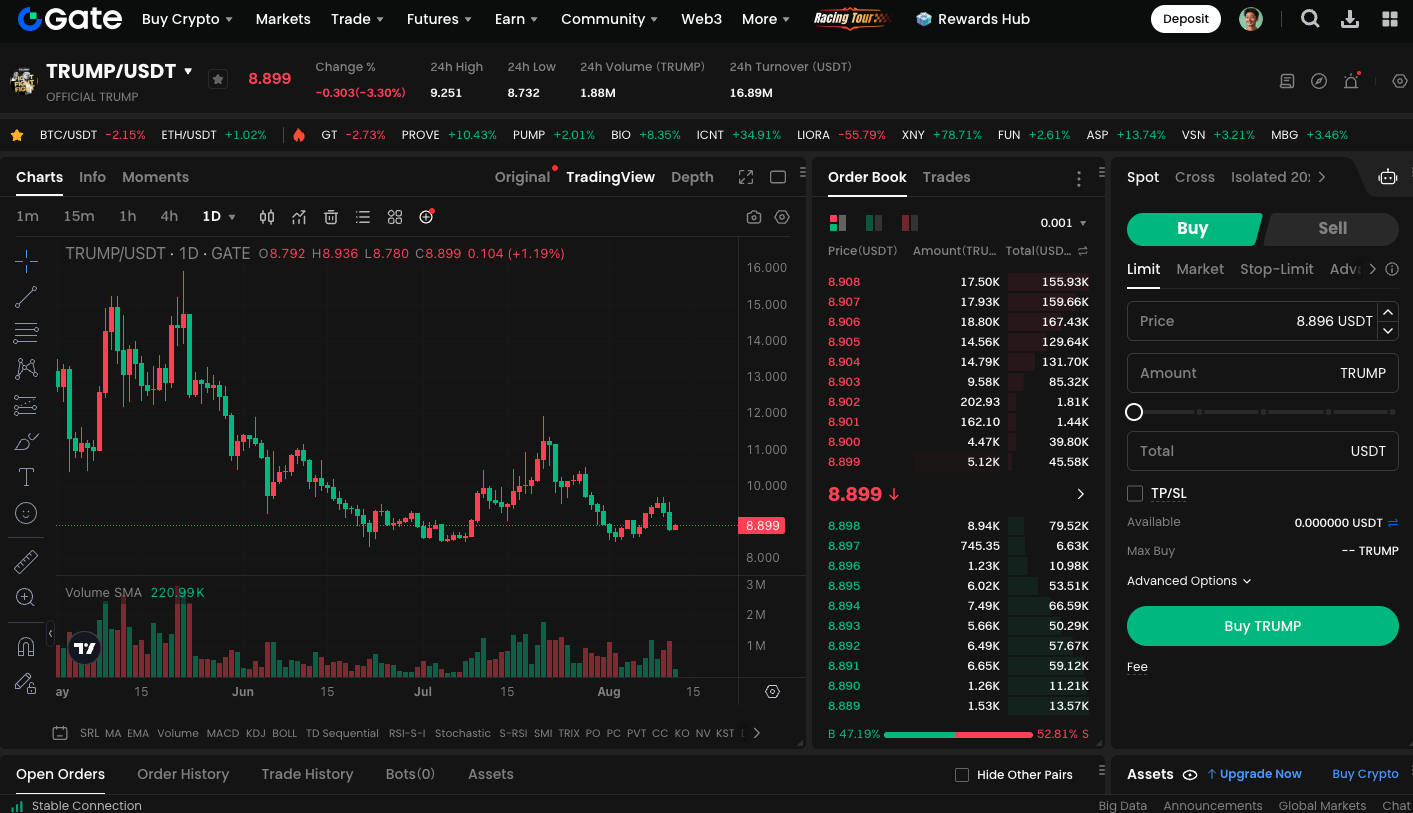

Recently, Trump Coin has been fluctuating around $8.9, with technical analysis indicating that the $8.3 to $8.5 range is a key support zone. If buyers successfully break the resistance band between $9.5 and $10, the price could surge to $12 or higher. Traders are closely watching for a spike in trading volume to confirm the continuation of the bullish trend if a breakout occurs.

Trump Family Expands Crypto Holdings

Beyond price movements, the Trump family’s recent business initiatives have also drawn significant attention. Their crypto venture, World Liberty Financial, announced a strategic partnership with U.S.-listed ALT5 Sigma Corporation, aiming to raise $1.5 billion for the purchase of their native token, WLFI.

ALT5 Sigma plans to raise capital by issuing and selling a combination of 200 million new and existing shares, with the proceeds directly funding the purchase of WLFI tokens. This financing strategy creates broader access for traditional investors to participate in crypto assets, which could indirectly increase awareness and liquidity for the TRUMP token.

From the Bitcoin Playbook to Diversified Asset Strategies

This approach is not a first in the market. In the past, prominent entrepreneur Michael Saylor turned MicroStrategy into a major Bitcoin reserve holder, prompting many publicly listed companies to follow suit. Today, beyond just Bitcoin, companies have targeted Ethereum (ETH), Sui (SUI), Binance Coin (BNB), Ethena (ENA), and other assets. Traditional capital is entering crypto markets through equity offerings.

Leadership Updates

This partnership also introduces leadership changes: World Liberty CEO Zach Witkoff will become Chairman of ALT5 Sigma; Eric Trump (son of former U.S. President Donald Trump) will join the board; and company COO Zak Folkman will serve as board observer. These moves reinforce the strategic ties between the companies and demonstrate the Trump family’s ongoing commitment to expanding its presence in the crypto sector.

Trade TRUMP spot now: https://www.gate.com/trade/TRUMP_USDT

Summary

Considering both the fundamentals and technical outlook, the short-term performance of the TRUMP token depends on breaking the $10 threshold. A successful breakout could ignite market sentiment. Fueled by the Trump family’s capital initiatives, it could attract even more investor interest in this emerging asset. Investors should monitor both short-term breakout signals and long-term allocation strategies to assess future price movements.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

Grok AI, GrokCoin & Grok: the Hype and Reality

How to Sell Pi Coin: A Beginner's Guide

Crypto Trends in 2025