ETH Price Prediction: Ethereum Profit-Taking Threatens Drop Toward $3,000

Market Overview

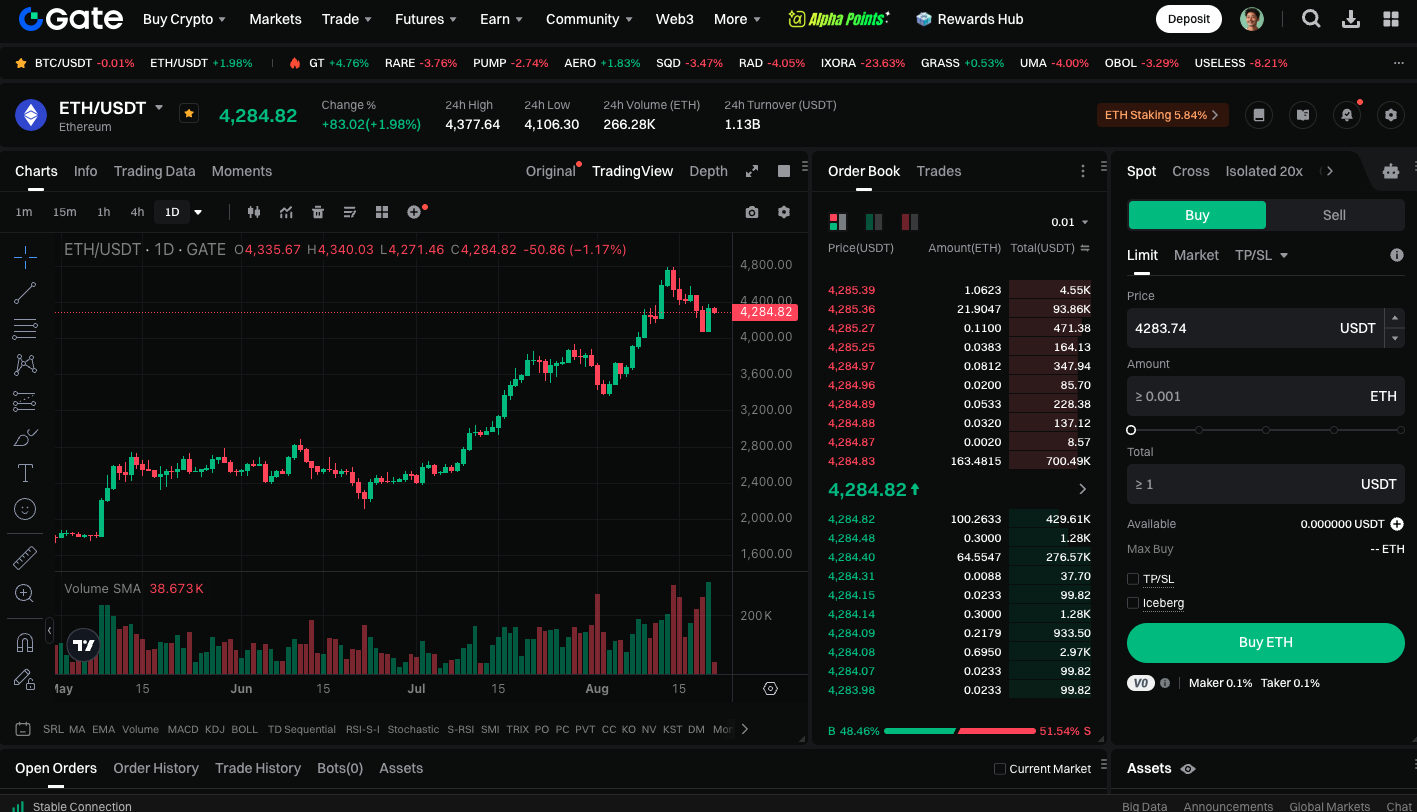

Ethereum (ETH) has recently experienced a notable correction, dropping from its previous high of $4,750 to around $4,290. Although the price is still holding above the critical $4,000 mark, several on-chain indicators point to the potential for greater downside risk in the market.

Rising Potential Sell Pressure

On-chain data reveals that Ethereum’s MVRV long-short position gap has risen to an annual high, indicating that long-term holders (LTHs) are sitting on larger unrealized gains. Historically, when this metric is excessively positive, it often signals that long-term investors are likely to take profits, creating additional sell pressure. The LTH NUPL (Net Unrealized Profit/Loss) has also climbed to an 8-month high. In the past, whenever this indicator exceeded 0.60, it closely aligned with short-term market tops for Ethereum. If this pattern repeats, ETH could face another significant correction.

$3,000 Could Be the Next Downside Test

As of this writing, ETH is trading near $4,290. If sell pressure escalates, Ethereum may fall below the $4,000 psychological threshold. Should the downturn intensify, the market could revisit previous correction patterns, with prices quickly retreating to the $3,000 zone or even dipping to $2,800—a region viewed by many traders as a potential strong support level.

The Bulls’ Last Hope

Despite the heightened risks, there are still bullish possibilities. If long-term holders continue to hold and ETH stabilizes above roughly $4,200, upward momentum could resume. The price could then challenge $4,500 and weaken the current bearish trend.

You can begin trading ETH spot: https://www.gate.com/trade/ETH_USDT

Summary

Short-term ETH price movement will depend on long-term holders’ selling activity. If selling persists, $3,000 will be the next crucial level to watch; if confidence holds, ETH could resume its upward trajectory.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

How to Sell Pi Coin: A Beginner's Guide

Grok AI, GrokCoin & Grok: the Hype and Reality

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025