Ethereum Price Breaks $4,300, Gate ETH Staking with 4.93% APY Now Open for a Limited Time

Ethereum Price Surges as Multiple Tailwinds Accelerate Value Recovery

According to the latest data, as of August 12, 2025, ETH is trading at approximately $4,265.32 USD. The market remains highly active: over the past week, ETH has soared by more than 21%, breaking above $4,300. Meanwhile, the United States is fueling institutional demand—President Trump signed an executive order allowing 401(k) retirement accounts to allocate funds to crypto assets, bringing a sustained influx of institutional capital and propelling both ETH and BTC markets higher.

In this climate, locking in stable on-chain yields is both timely and crucial.

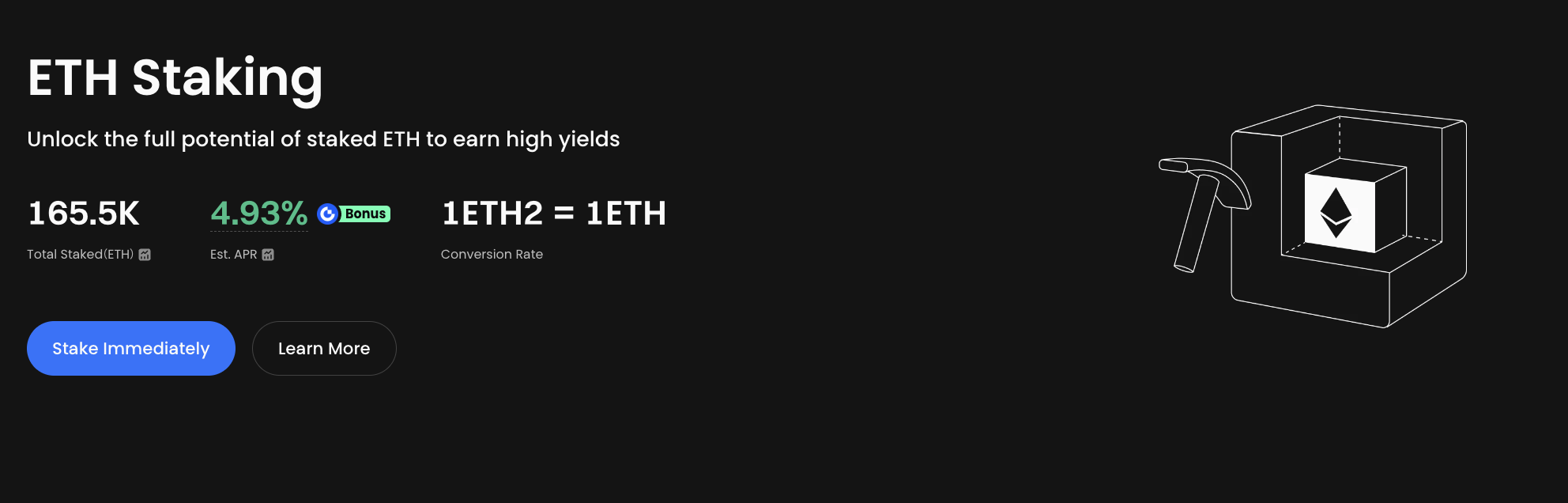

Gate ETH Staking: Product Highlights at a Glance (4.93% APY)

Source: https://www.gate.com/staking/ETH

Key Features:

- Earn up to 4.93% APY—competitive in the current market

- Start with as little as 0.00000001 ETH—low minimum investment

- No lock-up period—redeem anytime and receive staking rewards instantly upon redemption

- Daily distribution—stake on day D, you begin accruing earnings from D+1

- Additional GT rewards stack with the base yield to further increase overall returns

- Individual users can earn up to 1,000 ETH in rewards

Campaign Period & How to Participate

Event Period: August 5, 2025, 16:00 — August 15, 2025, 16:00 (UTC+8)

How to get started:

- Log in to the Gate platform (web or app)

- Navigate to “Finance” → “On-chain Earn,” then search for ETH products

- Enter your staking amount (minimum 0.00000001 ETH) and confirm participation

- Enjoy daily automatic rewards; redeem anytime and receive earnings in real-time

Yield details: Total APY = base rate 2.93% + additional GT rewards (actual returns may vary with market conditions; please refer to the subscription page for real-time figures)

Why Is ETH Staking a Strategic Move Right Now?

- The market is robust, with ETH consistently trading in the $4,200–$4,300 range and a clear bullish pattern

- Macro policy-driven momentum is fueling crypto liquidity: policies enabling retirement accounts to enter the space are driving mass inflows to ETFs and institutional vehicles, benefiting the entire crypto sector

- Gate’s platform stands out for its strong reputation and flexible product design: low minimums, daily rewards, flexible redemptions, and additional GT incentives work together to maximize user returns

- This approach lets users balance risk and opportunity. With a bullish outlook, ETH staking offers reliable returns; if the market corrects, the redemption feature provides ample flexibility

Risk Disclosure and Rational Recommendations

- Market volatility is a factor: ETH prices may see short-term corrections or fluctuations—assess your risk tolerance carefully

- Variable rewards: GT bonus rates are subject to market factors and platform policy. Returns may fluctuate, so keep an eye on the official info pages

- Policy and technical risks: Decentralized network upgrades or regulatory changes can impact staking mechanisms or overall yield structures

Strategic recommendations:

- New users should consider starting with small amounts to become familiar with the process and expected yields

- You may stagger your staking in batches to manage entry exposure

- If you expect long-term growth for ETH, you may increase your positions to take advantage of compounding growth

Summary

With Ethereum’s strong price momentum, increasing institutional participation, and a consistently positive policy environment, the Gate ETH Staking product stands out—offering 4.93% APY, low entry requirements, flexible redemption, and GT bonuses. For those seeking stable on-chain yields, this is an exceptional opportunity.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

Grok AI, GrokCoin & Grok: the Hype and Reality

How to Sell Pi Coin: A Beginner's Guide

Crypto Trends in 2025