Stock Plunges — What Secrets Did Coinbase’s Earnings Reveal?

After the earnings release, stock market data from STRONGData showed Coinbase shares fell more than 9% in after-hours trading to $377.7, then continued to slide over the following days, reaching a low of $314.

Spot Trading Volume Plunges Year-on-Year, BTC Holdings Top 11,000

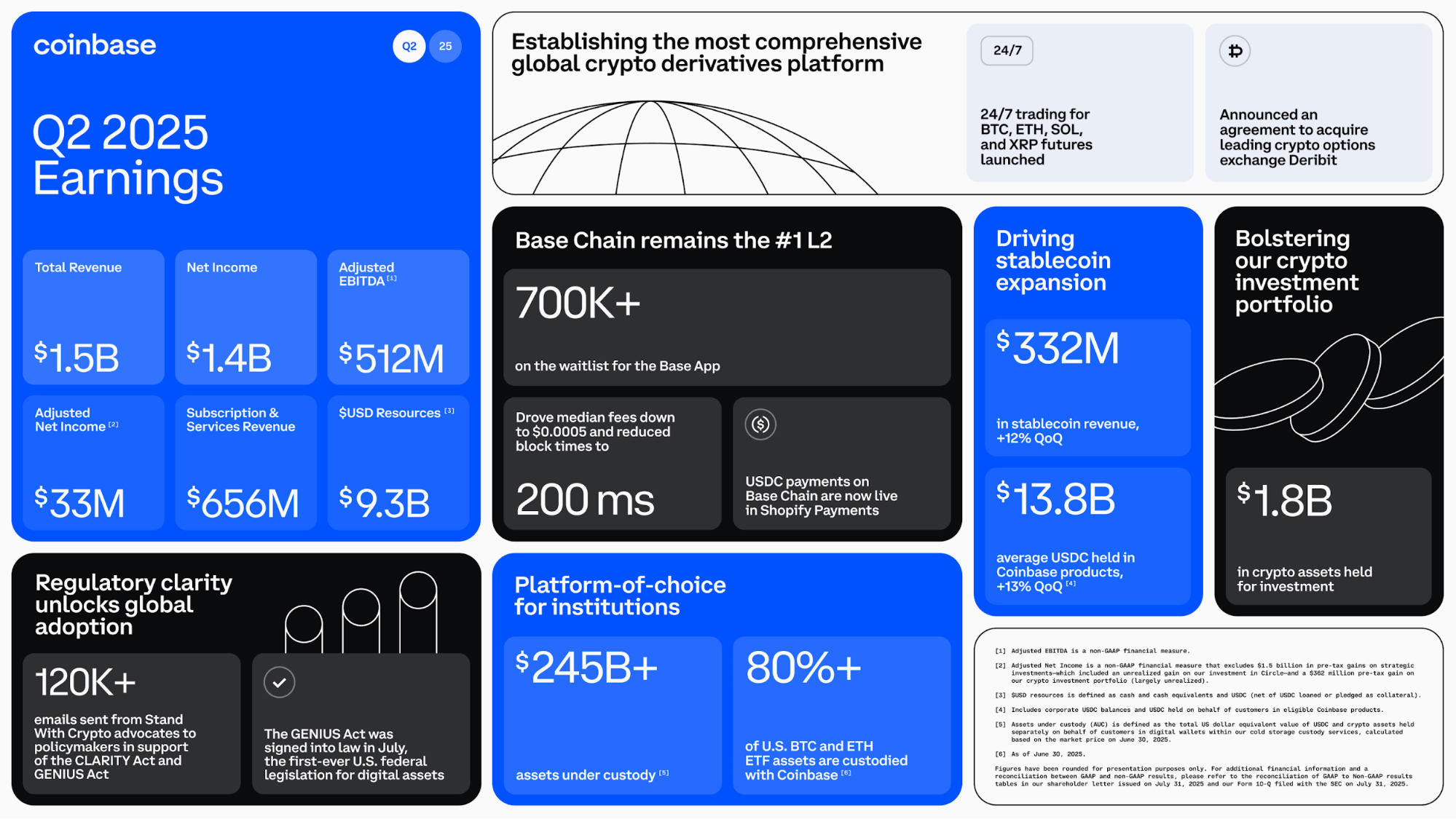

Coinbase’s latest financials for Q2 show total revenue at $1.5 billion—up year-on-year but missing analyst expectations of $1.59 billion. Net income reached $1.4 billion. This figure includes $1.5 billion in unrealized gains from strategic investments and $362 million in unrealized crypto asset gains. Adjusted net income excluding these factors was $33 million.

By revenue segment, Coinbase has three primary streams: transaction revenue, subscription revenue, and other revenue.

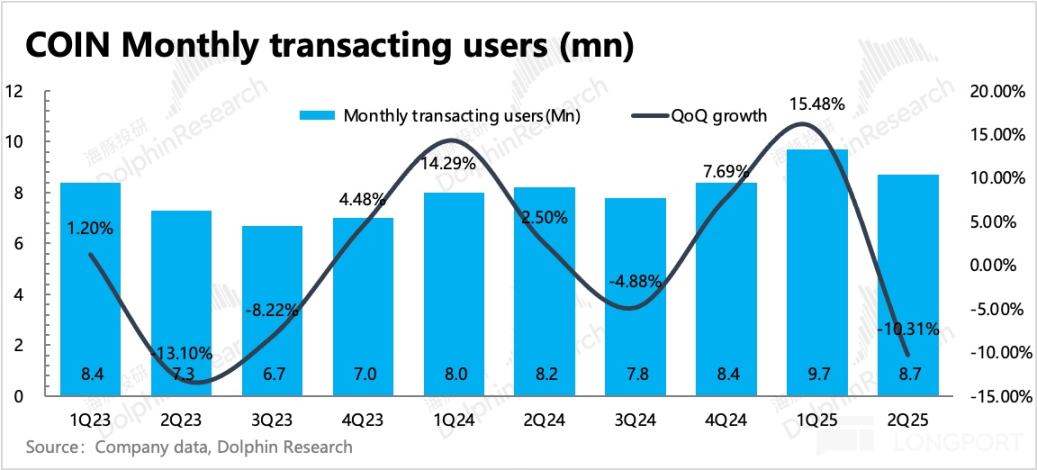

Transaction revenue was $764 million, a 39% year-on-year decline and well below market projections. Overall trading volume dropped 40% quarter-over-quarter, with retail volume down 45% and institutional down 38%. Retail trading revenue stood at $650 million (with $43 billion in trading volume). Institutional trading revenue was $60.8 million (with $194 billion in volume). Other transaction revenue was $54 million. The number of active traders fell by 1 million quarter-over-quarter to 8.7 million. The steep volume drop was mainly due to heightened caution among long-term users, with per-user trading volume down 38%.

Subscription and services revenue totaled $656 million, down 6% quarter-over-quarter. Stablecoin revenue (mainly USDC) came in at $333 million (up 12% quarter-over-quarter). Average USDC holdings on Coinbase were $13.8 billion, with $47.4 billion held off-platform.

Staking rewards generated $145 million (down 26% quarter-over-quarter), interest and financial fee income reached $59.3 million (down 6% quarter-over-quarter), and other subscription and service revenue was $120 million (down 15% quarter-over-quarter).

At Q2 close, Coinbase held $9.3 billion in U.S. dollar assets, a $590 million or 6% decrease from the previous quarter, mainly due to an uptick in fiat lending and crypto asset portfolio acquisitions. Cash and cash equivalents totaled $1.449 billion, net USDC stood at $1.784 billion, money market funds at $5.98 billion. Additionally, $110 million in cash was held on third-party platforms.

Coinbase announced via official tweet that it bought 2,509 BTC in Q2, lifting total BTC holdings to 11,776. The BTC portfolio cost $740 million and was valued at $1.26 billion at the reporting date.

Aggressive Acquisitions and Broad Business Expansion

As a major publicly traded U.S. exchange, Coinbase’s product suite spans the main Coinbase platform, Coinbase Pro (now Coinbase Advanced), Coinbase Wallet, Coinbase Card, Coinbase Earn, and Coinbase Cloud. These offerings cover retail and institutional clients, trading, custody, DeFi, and payments.

Recently, Coinbase has accelerated its acquisition strategy to diversify across new sectors. On July 29, Bloomberg reported that Coinbase was in advanced talks to acquire Indian crypto exchange CoinDCX; however, CoinDCX CEO Sumit Gupta quickly dismissed the report, stating the company would not be sold.

On July 11, Coinbase executed a talent acquisition, bringing on Opyn CEO Andrew Leone and Head of Research Joe Clark. Both joined the Onchain Markets team within Coinbase’s institutional division, focusing on verified liquidity pools and on-chain product development.

This year’s largest acquisition took place in May when Coinbase officially confirmed the purchase of cryptocurrency derivatives platform Deribit to unify spot, futures, and options trading. Coinbase valued the acquisition at approximately $2.9 billion, including $700 million in cash and 11 million shares of Coinbase Class A stock, which further strengthens its derivatives business. The company also recently acquired Liquifi, a token management platform, to expand its asset management and token issuance capabilities.

Separately, Coinbase has partnered with major traditional financial institutions—JPMorgan Chase, PNC Bank, and American Express—to advance fiat on-ramps and enable USDC rewards points redemption for users.

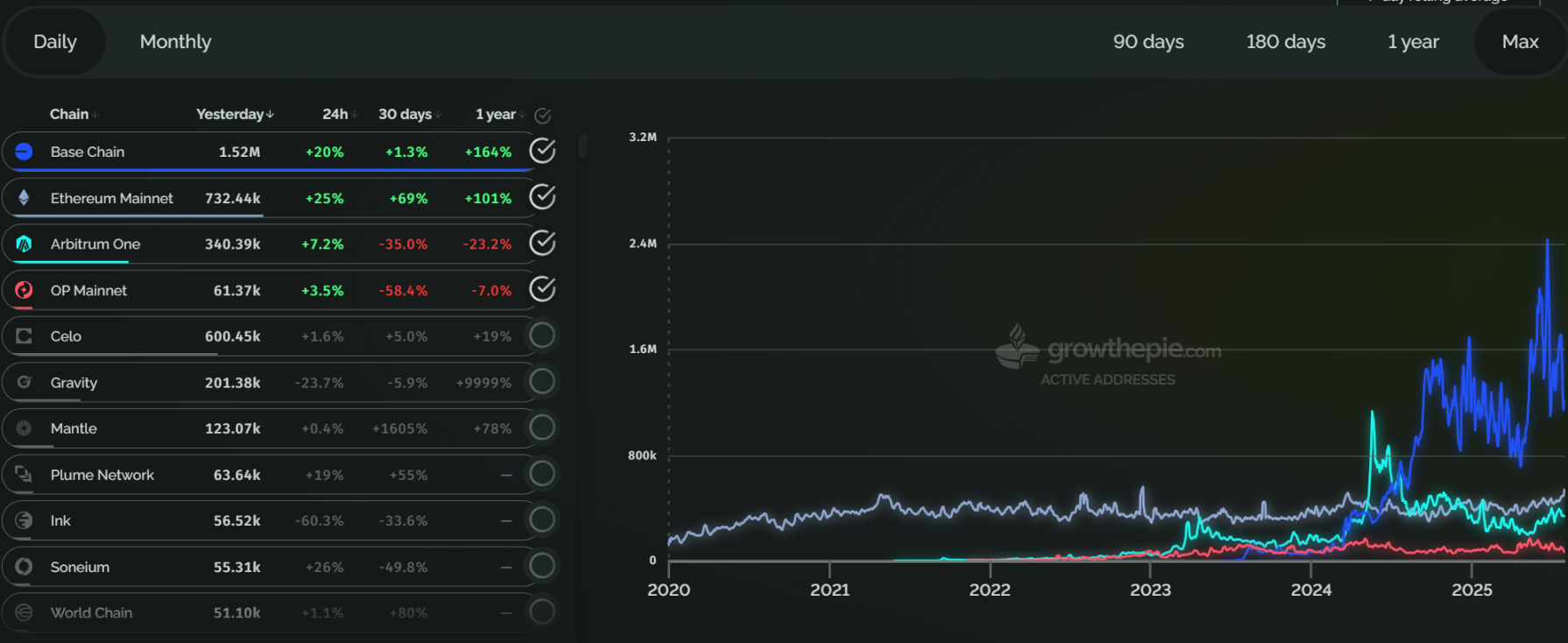

Coinbase’s earnings report highlights Base as one of the largest USDC distribution networks, with most P2P transactions on Base settling in USDC. The Base app is currently in public beta, offering integrated wallet, trading, payments, social, gaming, and DApp functionalities. The latest data from growthepie shows Base’s active address count far exceeds Optimism (OP) and Arbitrum.

On the compliance front, after the SEC dropped its lawsuit in February, Coinbase secured a MiCA license in Luxembourg in June. This authorizes it to offer retail and institutional financial services across 30 European Economic Area member countries, laying the groundwork for deepening its European presence.

Future Bets: Prediction Markets and Tokenized Stocks

Coinbase continues to expand into new fields.

Today, Coinbase VP of Product Max Branzburg told CNBC that Coinbase will soon broaden its U.S. service portfolio by building an all-in-one trading platform with tokenized stocks, prediction markets, early token sales, and more. An official video posted on Coinbase’s social channels confirmed this direction.

In prediction markets, Coinbase will face competition from Kalshi, currently the only federally licensed U.S. prediction market, and global leader Polymarket—which plans to reenter the U.S. after acquiring licensed derivatives exchange QCEX.

Coinbase’s tokenized stock offerings will also compete with similar products from Robinhood, Gemini, and Kraken; however, these platforms currently serve only non-U.S. investors.

Disclaimer:

- This article is republished from [Foresight News], copyright by the original author [1912212.eth, Foresight News]. If you have concerns regarding this republication, please contact the Gate Learn Team for prompt resolution following our standard procedures.

- Disclaimer: The views and opinions expressed are those of the author and do not constitute investment advice.

- Other language versions are translated by the Gate Learn Team and may not be reproduced, distributed, or copied without proper attribution to Gate.com.

Related Articles

Solana Need L2s And Appchains?

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What Is Ethereum 2.0? Understanding The Merge