With the GENIUS Act now enacted, how should we approach the stablecoin narrative with caution?

In the early hours today (Beijing time), the U.S. House of Representatives passed three major pieces of crypto legislation: the CLARITY Act, the GENIUS Act, and the Anti-CBDC Surveillance State Act. The GENIUS Act is expected to be signed into law by Trump this Friday, local time.

This is the first time the United States has put a national regulatory framework in place for stablecoins, making it clear that stablecoins are moving out of regulatory ambiguity and edging into the mainstream financial system. Meanwhile, major financial hubs like Hong Kong and the European Union are accelerating their own efforts, signaling that a global shake-up in the stablecoin sector is underway.

Looking back over the past few months, it’s evident that stablecoins have rapidly transitioned from being financial variables under regulatory scrutiny to becoming officially recognized foundational infrastructure. What sparked this dramatic change, who is driving stablecoins’ rise on the global financial stage, and how should we rationally interpret this surge in momentum?

From Web3 Narrative to National Strategy: Who’s Driving the Shift?

Since the beginning of this year, stablecoins have become a central focus for global financial policy and discussion.

This trend is no accident, nor just a product of technological evolution. It’s a structural shift primarily driven by policy, with the Trump administration acting as a major disruptive catalyst.

On one side, Trump has consistently opposed central bank digital currencies (CBDCs), openly supporting a market-driven pathway for a digital U.S. dollar. On the other, from endorsing the family business’s USD1 stablecoin to pushing for and preparing to sign the GENIUS Act, Trump is actively fulfilling his campaign promises to roll back crypto regulations.

This series of developments has prompted global regulators to re-examine stablecoins. In just a few months, stablecoins have moved from being a fringe topic in the crypto community to a major point of discussion at the national policy level. Beyond Hong Kong establishing a timeline for its Stablecoin Ordinance, the world’s leading economies are now simultaneously and seriously working to create clear compliance frameworks for stablecoins:

- The European Union’s Markets in Crypto-Assets (MiCA) regulation, which took effect in 2024, comprehensively covers crypto asset compliance and includes detailed categories for stablecoins.

- South Korea’s governing party, led by President Lee Jae-myung, has introduced the Basic Act on Digital Assets, permitting Korean firms with at least 500 million KRW (about $370,000) in capital and refund guarantees backed by reserves to issue stablecoins.

Put simply, the passage of the GENIUS Act is not just a U.S. deregulatory move on stablecoins—it’s a clear policy choice in favor of a privately issued digital dollar, rather than a central bank digital currency.

This U.S. stance will likely serve as a reference point for other countries’ regulatory designs and help shape stablecoins as a standard part of the global financial policy framework.

The Stablecoin Landscape Is Evolving

For several years, the stablecoin sector has been dominated by Tether (USDT) and Circle (USDC), representing “liquidity efficiency” and “regulatory transparency,” respectively:

- USDT prioritizes cross-platform liquidity and trading efficiency, maintaining dominance in exchanges and informal settlement networks.

- USDC focuses on compliance and transparency, gaining traction in regulated environments and with institutional clients.

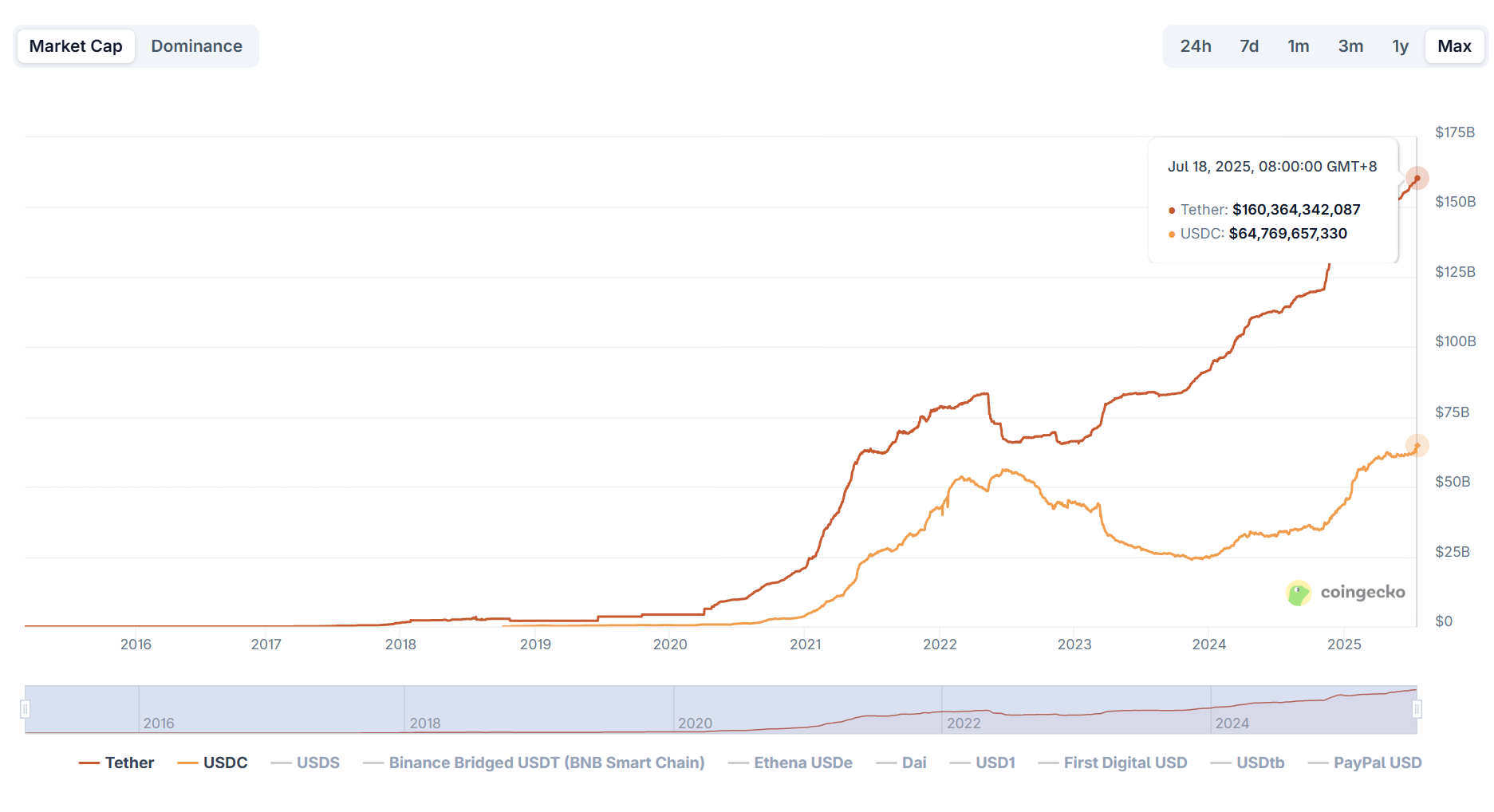

From a market perspective, stablecoins have continued to grow since 2025. According to CoinGecko, as of July 18, the total stablecoin market cap was about $262 billion—over 20% higher than at the start of the year.

This shows that as the crypto market rebounds, stablecoins remain the core “liquidity gateway.” The dominance of USDT and USDC is firmly intact—USDT’s market cap exceeds $160 billion (over 60% market share), and USDC holds near $65 billion (about 25% share), with these two controlling nearly 90% of the sector.

Since 2024, more Web2 financial institutions and traditional capital sources have entered the field, using stablecoins to build on-chain settlement tools. PayPal’s PYUSD and the politically backed USD1 are two standout examples:

PYUSD (PayPal USD), launched by payments giant PayPal, is naturally suited for cross-border settlements and supports a global merchant network. USD1, aiming for compliant on- and off-chain transactions and international business, benefits from Trump’s political endorsement and targets corporate settlement scenarios.

With institutional and governmental backing, these emerging stablecoins are expanding the role of stablecoins from “Web3 liquidity tools” to bridges linking Web3 and the real economy. Their use cases are moving beyond exchanges and wallets to impact supply chain finance, cross-border trade, freelancer settlement, OTC transactions, and more.

Behind the Rapid Growth: What Are the True Challenges for Stablecoins?

While the GENIUS Act gives stablecoins formal legal recognition, it also imposes more stringent compliance demands and clearer regulatory boundaries.

Issuers must now adhere to KYC/AML requirements; funds must be held in segregated custody and subject to third-party audits; in some situations, caps on issuance amounts or usage limits may be imposed. This means stablecoins are now officially regulated currencies, not just recognized assets.

From this perspective, the real test for stablecoins is whether they can break out of their Web3-specific use cases to achieve broader adoption—because the greatest growth potential lies not within the crypto world, but across the greater Web2 and global real economy.

Growth for USDT and USDC is now driven primarily by small and midsize businesses and individual merchants with strong cross-border settlement needs, users in emerging markets unable to access SWIFT, residents of inflation-prone countries seeking escape from local currency volatility, and creators or freelancers who can’t use PayPal or Stripe, among others.

In short, the next wave of stablecoin growth will not come from Web3, but from Web2—the “killer app” is not another DeFi protocol, but replacing traditional U.S. dollar bank accounts.

If stablecoins become the global foundational vehicle for digital U.S. dollars, they will inevitably impact issues around monetary sovereignty, financial sanctions, and geopolitical order.

As a result, the future of stablecoin expansion will track closely with the evolution of the U.S. dollar’s global reach and will become a new battleground among governments, international bodies, and financial powerhouses.

Conclusion

The essence of currency issuance has always been an extension of sovereign power—supported not just by reserve assets and efficient settlement, but by national credibility, regulatory approval, and international status.

The same holds true for stablecoins: bridging from the crypto world into the real economy will require more than just market mechanisms or business logic. While the regulatory shift in 2025 is a critical enabler for mainstream adoption, it also signals that stablecoins must now navigate a far more complex and competitive landscape.

This is a long-term contest, and we are only witnessing its true beginning.

Disclaimer:

- This article is reprinted from [TechFlow], with copyright belonging to the original author [imToken]. For republication concerns, please contact the Gate Learn Team, who will promptly address your request through the appropriate channels.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article have been translated by the Gate Learn Team. Do not copy, distribute, or plagiarize translations without reference to Gate as the source.