Agent Memory ≠ Agent History

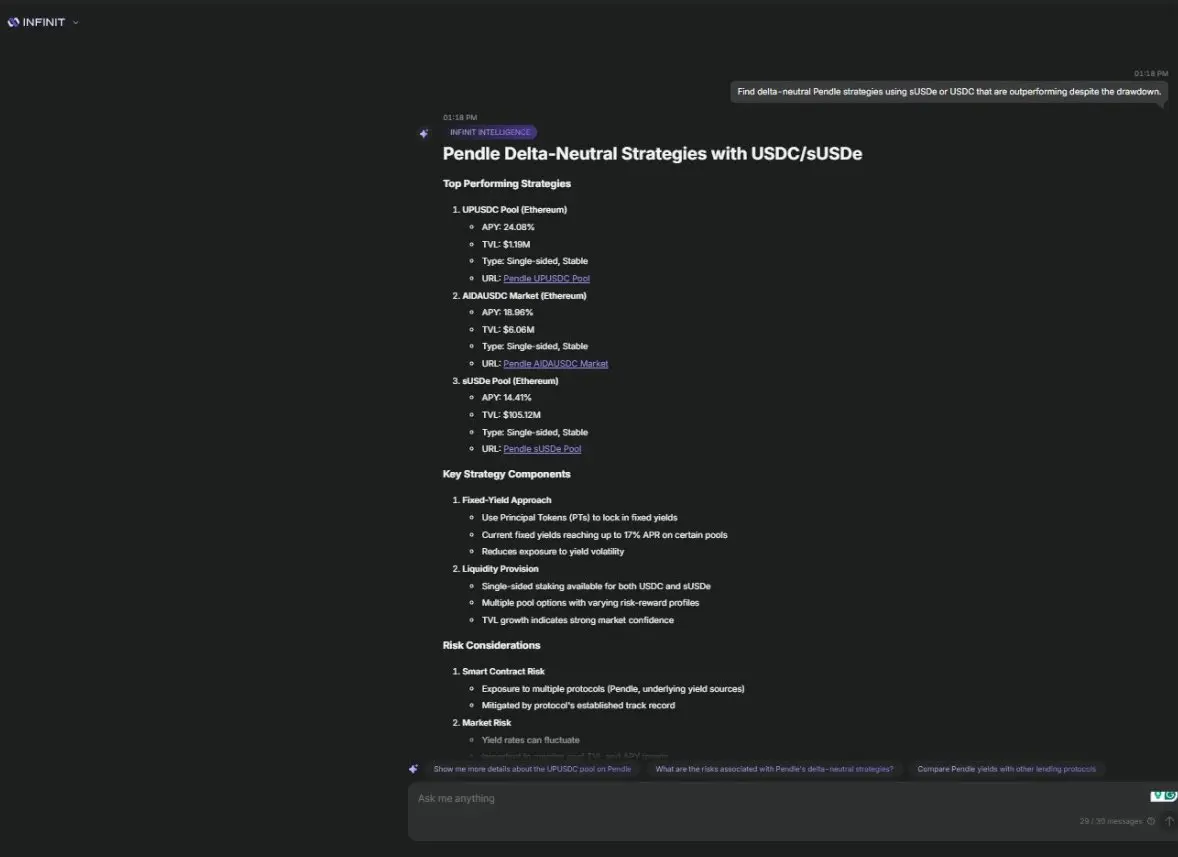

Here’s how @Infinit_Labs is redefining DeFi automation through coordinated AI agents...and why coordination could be the next competitive edge. [🧵]

i/ 𝗪𝗵𝘆 𝗗𝗲𝗙𝗶 𝗔𝘂𝘁𝗼𝗺𝗮𝘁𝗶𝗼𝗻 𝗜𝘀𝗻’𝘁 𝗘𝗻𝗼𝘂𝗴𝗵

DeFi has plenty of automation but often lacks coordination.

Many bots rely on rigid scripts, executing strategies in isolation without adapting to changing conditions. This leaves DeFi fast but vulnerable, reactive, not adaptive, and profitable only until markets shift.

INFINIT is building something different: a swarm of AI-driven agents that don’t just exe

Here’s how @Infinit_Labs is redefining DeFi automation through coordinated AI agents...and why coordination could be the next competitive edge. [🧵]

i/ 𝗪𝗵𝘆 𝗗𝗲𝗙𝗶 𝗔𝘂𝘁𝗼𝗺𝗮𝘁𝗶𝗼𝗻 𝗜𝘀𝗻’𝘁 𝗘𝗻𝗼𝘂𝗴𝗵

DeFi has plenty of automation but often lacks coordination.

Many bots rely on rigid scripts, executing strategies in isolation without adapting to changing conditions. This leaves DeFi fast but vulnerable, reactive, not adaptive, and profitable only until markets shift.

INFINIT is building something different: a swarm of AI-driven agents that don’t just exe