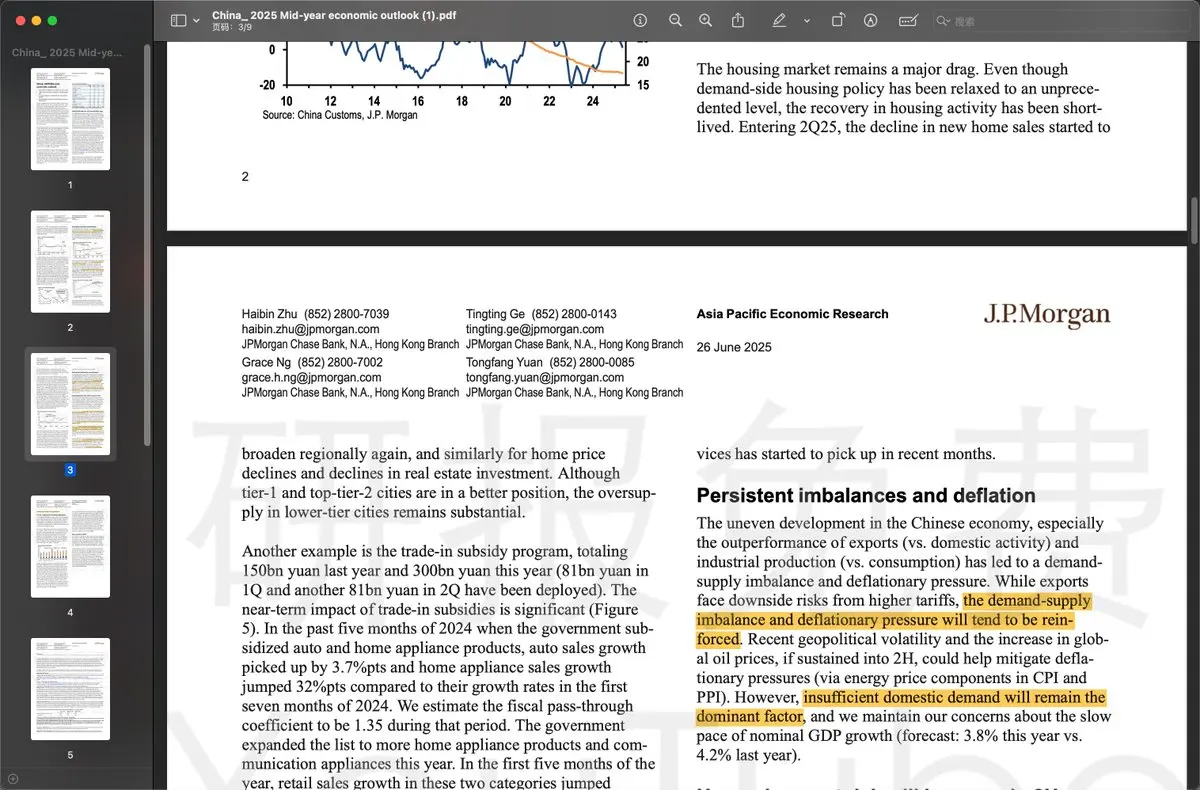

The reason why A-shares, particularly bank stocks, rose sharply some time ago is mainly due to insurance funds entering the market and buying bank stocks in large quantities (similar logic to gold). In the current deflationary environment in the country, there is an asset shortage. The normal logic would be to buy gold, Dividend-type, and fixed income, so the actions of the insurance funds are justified (with tasks).

However, this does not mean that bank stocks are safe assets. With the net interest margin hitting a new low, coupled with various local government financing bonds, hidden local d

View Original